You will be finding bond-like returns and also you eliminate the possibility of obtaining bigger returns during the inventory sector in exchange for the guaranteed income. Because payments are for all times, You furthermore mght get more payments (and an improved Total return) if you reside lengthier.

Gold and silver funds aren’t direct investments, on the other hand, and they generally is not going to observe the exact cost of physical gold. Having said that, they do nevertheless deliver traders Along with the diversification of physical gold or silver without the carrying expenses.

Shorter-phrase bonds are inclined to provide decreased interest costs; having said that, Additionally they tend to be a lot less impacted by uncertainty in future yield curves. Investors extra comfortable with chance may perhaps consider adding for a longer time time period bonds that are likely to pay larger levels of curiosity.

Fewer regulation: These retirement plans ordinarily reduce the level of regulation demanded as opposed to a standard plan, this means it’s much easier to administer them.

Assured income annuities are generally not offered by employers, but persons can buy these annuities to make their own pensions. It is possible to trade a giant lump sum at retirement and buy a direct annuity to obtain a regular monthly payment for all times, but plenty of people aren't relaxed with this particular arrangement. More well-liked are deferred revenue annuities which have been paid into with time.

discovered you can find just too a lot of variables to look at, and "an best amount of shares that constitute a well-diversified portfolio would not exist."

Like futures, gold and silver options are much less cash intensive, enabling for more leverage. The draw back hazard is limited to dropping the price of the option if it expires worthless, even though the potential for financial gain with some options strategies is theoretically unrestricted.

For people trying to own physical gold in a tax-advantaged account, putting together a self-directed IRA with a custodian and authorized depository is required. Locating the correct firm for the gold IRA can simplify things a great deal.

Arielle O’Shea leads the investing and taxes crew at NerdWallet. She has covered personal finance and investing for more than fifteen years, and was a senior author and spokesperson at additional resources NerdWallet before becoming an assigning editor. Previously, she was a researcher and reporter for foremost private finance journalist and author Jean Chatzky, a role that included acquiring financial education programs, interviewing material experts and helping to generate television and radio segments.

It's a fantastic rule if thumb to save lots of for retirement Whilst you're constructing your emergency fund — particularly when you might have an employer retirement plan that matches any portion of your contributions.

editorial click here for info integrity , this publish could have references to products and solutions from our associates. Here's an explanation for

In any situation, the most effective technique to secure your economical foreseeable future will be to best out your accounts, preserving the most legal quantities each and every year.

Your investments You should not always need regular babysitting. If you want to take care of your retirement savings by yourself, you are able to do it with just a handful of minimal-Price mutual funds. All those her comment is here who prefer Skilled steering can seek the services of a monetary advisor.

What it means for you: A standard IRA is probably the greatest retirement plans about, even though if you will get a 401(k) plan using a matching contribution, that’s to some degree superior.

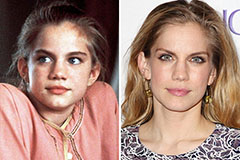

Anna Chlumsky Then & Now!

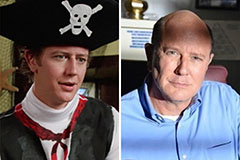

Anna Chlumsky Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Shane West Then & Now!

Shane West Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!